Rupert Read

@GreenRupertRead

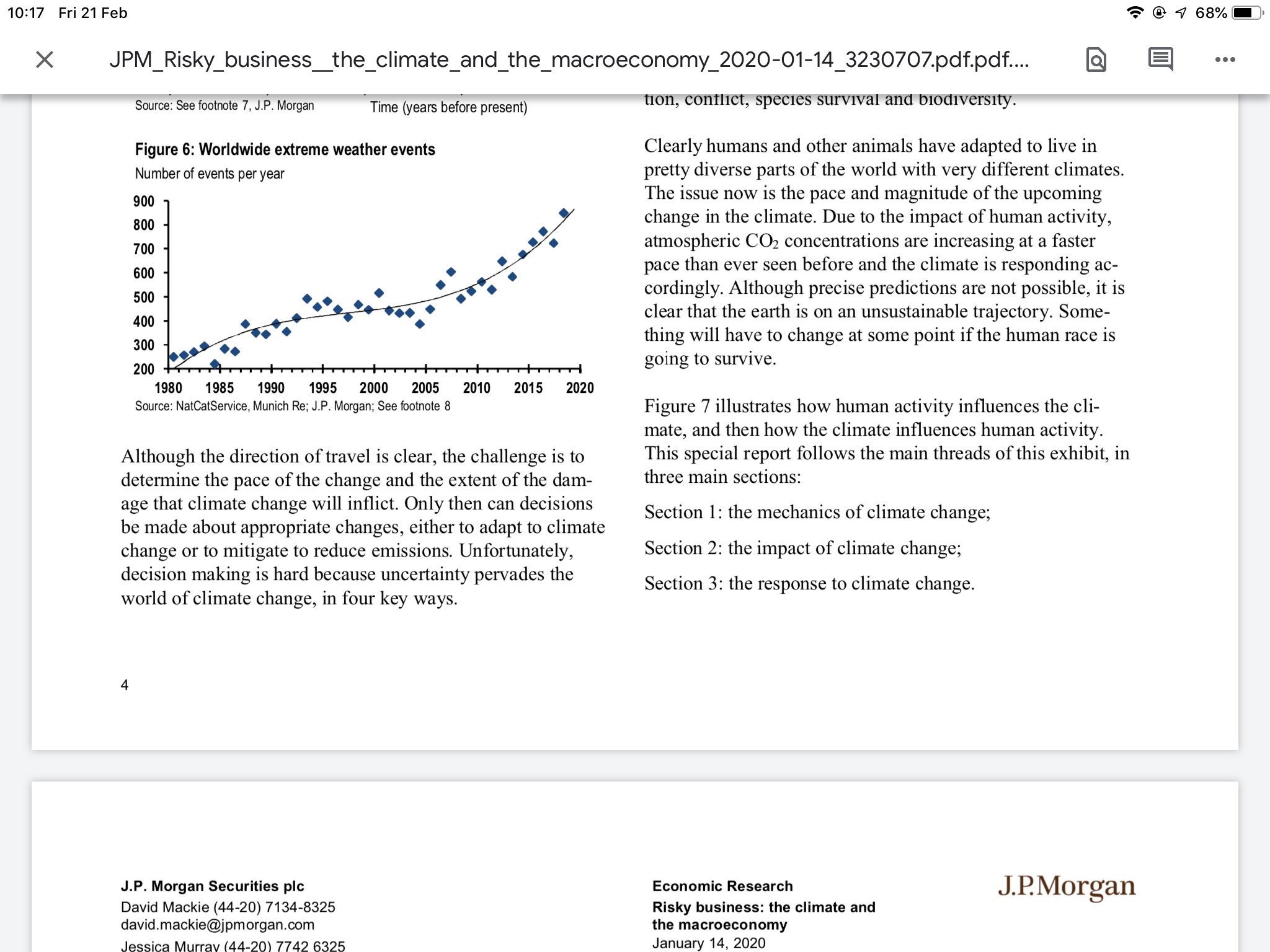

Here’s a screenshot of the most astonishing & distressing page from the private JP Morgan report that I have been able to help leak. “[It] is clear that the earth is on an unsustainable trajectory. Something will have to change at some point if the human race is going to survive”

If this trajectory graph is since 1980 only, it’s pretty clear that as a species, we are in very real trouble.

https://theguardian.com/environment/2020/feb/21/jp-morgan-economists-warn-climate-crisis-threat-human-race?CMP=Share_iOSApp_Other… The #ExtinctionRebellion story that I helped make happen - about the report that JP Morgan didn’t want you to read, about the real risk of human extinction from climate breakdown - now topping the Guardian listings for most-read:

FIND OUT MORE ABOUT WHY:

Shares

6,049

The JP Morgan paper said ‘catastrophic outcomes’ could not be ruled out. Photograph: Dimitar Dilkoff/AFP via Getty Images

The world’s largest financier of fossil fuels has warned clients that the climate crisis threatens the survival of humanity and that the planet is on an unsustainable trajectory, according to a leaked document.

The JP Morgan report on the economic risks of human-caused global heating said climate policy had to change or else the world faced irreversible consequences.

The study implicitly condemns the US bank’s own investment strategy and highlights growing concerns among major Wall Street institutions about the financial and reputational risks of continued funding of carbon-intensive industries, such as oil and gas.

JP Morgan has provided $75bn (£61bn) in financial services to the companies most aggressively expanding in sectors such as fracking and Arctic oil and gas exploration since the Paris agreement, according to analysis compiled for the Guardian last year.

Advertisement

Its report was obtained by Rupert Read, an Extinction Rebellion spokesperson and philosophy academic at the University of East Anglia, and has been seen by the Guardian.

The research by JP Morgan economists David Mackie and Jessica Murray says the climate crisis will impact the world economy, human health, water stress, migration and the survival of other species on Earth.

“We cannot rule out catastrophic outcomes where human life as we know it is threatened,” notes the paper, which is dated 14 January.

Drawing on extensive academic literature and forecasts by the International Monetary Fund and the UN Intergovernmental Panel on Climate Change (IPCC), the paper notes that global heating is on course to hit 3.5C above pre-industrial levels by the end of the century. It says most estimates of the likely economic and health costs are far too small because they fail to account for the loss of wealth, the discount rate and the possibility of increased natural disasters.

Sign up to the Green Light email to get the planet's most important stories

Read more

The authors say policymakers need to change direction because a business-as-usual climate policy “would likely push the earth to a place that we haven’t seen for many millions of years”, with outcomes that might be impossible to reverse.

“Although precise predictions are not possible, it is clear that the Earth is on an unsustainable trajectory. Something will have to change at some point if the human race is going to survive.”

The investment bank says climate change “reflects a global market failure in the sense that producers and consumers of CO2 emissions do not pay for the climate damage that results.” To reverse this, it highlights the need for a global carbon tax but cautions that it is “not going to happen anytime soon” because of concerns about jobs and competitiveness.

The authors say it is “likely the [climate] situation will continue to deteriorate, possibly more so than in any of the IPCC’s scenarios”.

Without naming any organisation, the authors say changes are occurring at the micro level, involving shifts in behaviour by individuals, companies and investors, but this is unlikely to be enough without the involvement of the fiscal and financial authorities.

Last year, analysis compiled for the Guardian by Rainforest Action Network, a US-based environmental organisation, found JP Morgan was one of 33 powerful financial institutions to have provided an estimated total of $1.9tn (£1.47tn) to the fossil fuel sector between 2016 and 2018.

A JP Morgan spokesperson told the BBC the research team was “wholly independent from the company as a whole, and not a commentary on it”, but declined to comment further. The metadata on the pdf of the report obtained by Read said the document was created on 13 January and that the author of the file was Gabriel de Kock, executive director of JP Morgan. The Guardian has approached the investment bank for comment.

Pressure from student strikers, activist shareholders and divestment campaigners has prompted several major institutions to claim they will make the climate more of a priority. The business model of fossil fuel companies is also weakening as wind and solar become more competitive. Earlier this month, the influential merchant bank Goldman Sachs downgraded ExxonMobil from a “neutral” to a “sell” position. In January, BlackRock – the world’s biggest asset manager – said it would lower its exposure to fossil fuels ahead of a “significant reallocation of capital”.

Environmental groups remain wary because huge sums are invested in petrochemical firms, but some veteran financial analysts say the tide is changing. The CNBC money pundit Jim Cramer shocked many in his field when he declared: “I’m done with fossil fuels. They’re done. They’re just done.”

The world’s largest financier of fossil fuels has warned clients that the climate crisis threatens the survival of humanity and that the planet is on an unsustainable trajectory, according to a leaked document.

The JP Morgan report on the economic risks of human-caused global heating said climate policy had to change or else the world faced irreversible consequences.

The study implicitly condemns the US bank’s own investment strategy and highlights growing concerns among major Wall Street institutions about the financial and reputational risks of continued funding of carbon-intensive industries, such as oil and gas.

JP Morgan has provided $75bn (£61bn) in financial services to the companies most aggressively expanding in sectors such as fracking and Arctic oil and gas exploration since the Paris agreement, according to analysis compiled for the Guardian last year.

Advertisement

Its report was obtained by Rupert Read, an Extinction Rebellion spokesperson and philosophy academic at the University of East Anglia, and has been seen by the Guardian.

The research by JP Morgan economists David Mackie and Jessica Murray says the climate crisis will impact the world economy, human health, water stress, migration and the survival of other species on Earth.

“We cannot rule out catastrophic outcomes where human life as we know it is threatened,” notes the paper, which is dated 14 January.

Drawing on extensive academic literature and forecasts by the International Monetary Fund and the UN Intergovernmental Panel on Climate Change (IPCC), the paper notes that global heating is on course to hit 3.5C above pre-industrial levels by the end of the century. It says most estimates of the likely economic and health costs are far too small because they fail to account for the loss of wealth, the discount rate and the possibility of increased natural disasters.

Sign up to the Green Light email to get the planet's most important stories

Read more

The authors say policymakers need to change direction because a business-as-usual climate policy “would likely push the earth to a place that we haven’t seen for many millions of years”, with outcomes that might be impossible to reverse.

“Although precise predictions are not possible, it is clear that the Earth is on an unsustainable trajectory. Something will have to change at some point if the human race is going to survive.”

The investment bank says climate change “reflects a global market failure in the sense that producers and consumers of CO2 emissions do not pay for the climate damage that results.” To reverse this, it highlights the need for a global carbon tax but cautions that it is “not going to happen anytime soon” because of concerns about jobs and competitiveness.

The authors say it is “likely the [climate] situation will continue to deteriorate, possibly more so than in any of the IPCC’s scenarios”.

Without naming any organisation, the authors say changes are occurring at the micro level, involving shifts in behaviour by individuals, companies and investors, but this is unlikely to be enough without the involvement of the fiscal and financial authorities.

Last year, analysis compiled for the Guardian by Rainforest Action Network, a US-based environmental organisation, found JP Morgan was one of 33 powerful financial institutions to have provided an estimated total of $1.9tn (£1.47tn) to the fossil fuel sector between 2016 and 2018.

A JP Morgan spokesperson told the BBC the research team was “wholly independent from the company as a whole, and not a commentary on it”, but declined to comment further. The metadata on the pdf of the report obtained by Read said the document was created on 13 January and that the author of the file was Gabriel de Kock, executive director of JP Morgan. The Guardian has approached the investment bank for comment.

Pressure from student strikers, activist shareholders and divestment campaigners has prompted several major institutions to claim they will make the climate more of a priority. The business model of fossil fuel companies is also weakening as wind and solar become more competitive. Earlier this month, the influential merchant bank Goldman Sachs downgraded ExxonMobil from a “neutral” to a “sell” position. In January, BlackRock – the world’s biggest asset manager – said it would lower its exposure to fossil fuels ahead of a “significant reallocation of capital”.

Environmental groups remain wary because huge sums are invested in petrochemical firms, but some veteran financial analysts say the tide is changing. The CNBC money pundit Jim Cramer shocked many in his field when he declared: “I’m done with fossil fuels. They’re done. They’re just done.”

Describing how a new generation of pension fund managers was withdrawing support, he claimed oil and gas firms were in the death knell phase. “The world has turned on them. It’s actually happening kind of quickly. You’re seeing divestiture by a lot of different funds. It’s going to be a parade that says, ‘Look, these are tobacco. And we’re not going to own them,’” he said. “We’re in a new world.”

No comments:

Post a Comment